From AccountingToday.com — By Michael Cohn —

The Internal Revenue Service audited fewer taxpayers last year, according to a new report, although audits of millionaires ticked up slightly.

The report, released Wednesday by Syracuse University’s Transactional Records Access Clearinghouse, found that in fiscal year 2022, the IRS audited 626,204 returns (out of more than 164 million individual income tax returns filed), down from 659,003 during FY 2021. The IRS is increasingly relying on correspondence audits. Only 93,595 of the audits were regular audits, compared to 532,609 correspondence audits, with about 85% of audits conducted through the mail.

“Together this means that last year the odds of audit had fallen to 3.8 out of every 1,000 returns filed (0.38%),” said the TRAC report. “For FY 2021, the odds of audit had been 4.1 out of every 1,000 returns filed (0.41%).”

In response to persistent complaints about the IRS failing to properly audit high-income taxpayers, the number of audits of millionaires ticked up slightly after years of declines, but those audits too were mostly via letters. Last year, 48% of millionaire audits consisted of correspondence audits, but still most millionaires avoid tax audits.

“Adding those who received a letter asking for more documentation on a specific item, the odds of millionaires receiving some attention by the IRS rose to 2.8%,” said the report. “Yet this left somewhat under 700,000 millionaires — taxpayers reporting a million or more in total positive income — with absolutely no scrutiny whatsoever.”

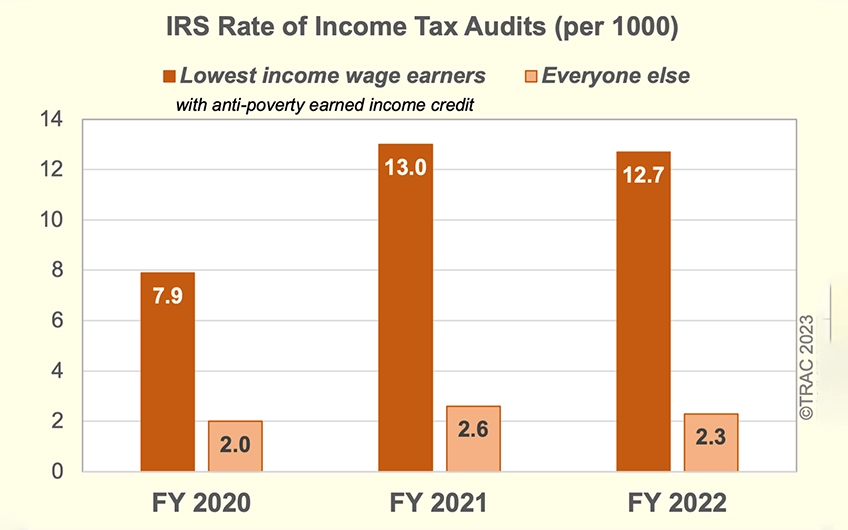

Millionaires did have the highest odds of being audited, the report acknowledged, but the odds that millionaires received a regular audit by a revenue agent (1.1%) were less than the audit rate of the targeted lowest-income wage-earners, whose audit rate was 1.27%. The taxpayer category who saw audit rates five and a half times more than nearly everyone else were low-income wage-earners claiming the Earned Income Tax Credit.

EITC claimants have historically been targeted for examinations not because they account for the most tax under-reporting, the report noted, but because they are relatively easy targets at a time when the IRS increasingly relies upon correspondence audits but doesn’t have the resources to help taxpayers or answer their questions.

The IRS received a funding boost of $80 billion over the next 10 years from last year’s Inflation Reduction Act. Some of that funding will be used to increase tax audits and close the tax gap, but mainly it’s supposed to be spent on improving taxpayer service, replacing retiring IRS employees and upgrading the IRS’s aging technology systems. Republican members of the House have promised to introduce legislation to prevent the IRS from accessing the extra funds or using the money to hire more IRS agents.

Michael Cohn is Editor-in-Chief of AccountingToday.com.

Contact Pinnacle CPA Advisory Group

If you need tax help or any kind of accounting services, contact the experts at Pinnacle CPA Advisory Group. Reach us by calling our office at (614) 942-1990, sending email to [email protected], or by filling out the Contact form on this website at cpaagi.com/contact.