Featured Articles & Tax Tips Blog

Welcome to the CPA Advisory Group’s Featured Articles Blog. Here we share tax and accounting news and tips for our clients on a regular basis. Please feel free to suggest ideas for topics you would like to see addressed, by dropping an email to [email protected]. Enjoy the articles and subscribe to our newsletter for periodic email updates.

Ready to become self-employed? Consider the tax implications

Thomson-Reuters — Are you about ready to join the "Great Resignation" and become self-employed? If so, you need to consider the federal tax implications, which may not be as rosy as you think. Here are what we think are the most important things to know to make a good...

Mid-year tax planning Part 3: Virtual currency, reverse mortgages, and small business strategies

From the Pinnacle CPA Advisory Group — Dear Clients and Friends, Today we conclude our three-week look at mid-year tax planning for 2022. In Part 3 of the series, we address cryptocurrency, reverse mortgages, and a number of strategies to pursue to mitigate your tax...

Mid-year tax planning, Part 2: Time your gains/losses; Bunch your deductions

From the Pinnacle CPA Advisory Group — Dear Clients and Friends, Today we continue our look at mid-year tax planning for 2022. In Part 2 of our three-week series, we discuss how to plan the timing of your expected investment gains and losses, and strategy for...

Mid-year tax planning, Part 1: Check withholding; Plan for taxes on investments

From the Pinnacle CPA Advisory Group — Dear Clients and Friends, Another challenging year has just passed. While the COVID-19 crisis has lessened, international events have led to supply chain issues and inflationary prices. Since income may not rise at the same rate...

Pay up? The IRS is sending millions of tax payment letters this month

From CBS News/Moneywatch — BY AIMEE PICCHI — The IRS this month will send millions of letters to taxpayers whom it believes underpaid the tax agency. It's important to pay attention to this letter — called a CP14 — because ignoring it could lead to penalties. The IRS...

Kakeibo: The Japanese art of mindful budgeting

From NextAvenue.org — By Jennifer Nelson — Looking to declutter your finances? Consider Kakeibo (pronounced kah-keh-boh), a Japanese budgeting system that literally translates to "household financial ledger." Created in 1904 by Japan's first female journalist, Hani...

If you filed for an extension, you have until Oct. 17 to file. Don’t wait

From Time.com/nextadvisor — By Dashia Milden — The 2022 tax season was rocky — from an IRS processing backlog to refund delays and filing errors as a result of changes to the tax code. As a result, the IRS predicted more than 15 million taxpayers would file for an...

Which electric cars are eligible for the $7,500 tax credit?

From Cars.com — By Brian Normile — If you’ve been shopping for or researching an electric vehicle, you’ve almost certainly heard about things like EV tax credits, specifically the federal government’s offer of a federal tax credit worth up to $7,500 if you purchase...

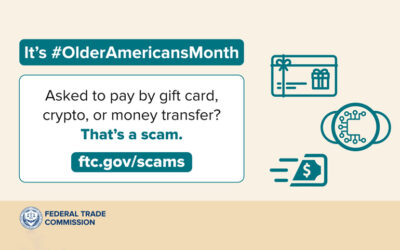

Avoid scammers’ money grabs during Older Americans Month

From the Federal Trade Commission's FTC.gov — Scammers use lots of different tactics — stories about grandchildren in distress, million-dollar prizes, a romantic future, or a business deal — to try to steal peoples’ money. Scammers may demand payment by wire...

How your Medicare premiums can affect your taxes

From Thomson-Reuters and the Pinnacle CPA Advisory Group — Medicare health insurance premiums can add up to big bucks, especially if your income exceeds certain thresholds. Here's a summary of the different types of Medicare premiums and how they can affect your...

High inflation: How long will it last?

From Pinnacle Wealth Planning Services, Inc. — In March 2022, the Consumer Price Index for All Urban Consumers (CPI-U), the most common measure of inflation, rose at an annual rate of 8.5%, the highest level since December 1981.1 It's not surprising that a Gallup...

National Small Business Week: Plan to use ’22 tax benefits

From IRS.gov — Enhanced deduction for business meals, home office and more available this tax year WASHINGTON — The Internal Revenue Service on Monday, May 3, urged business taxpayers to begin planning now to take advantage of the enhanced 100% deduction for business...