Featured Articles & Tax Tips Blog

Welcome to the CPA Advisory Group’s Featured Articles Blog. Here we share tax and accounting news and tips for our clients on a regular basis. Please feel free to suggest ideas for topics you would like to see addressed, by dropping an email to [email protected]. Enjoy the articles and subscribe to our newsletter for periodic email updates.

401(k) limits, ‘super catch-up’ contributions, increase in 2025

From USA Today – By Medora Lee – Americans will be able to sock away more in their workplace retirement plans, before taxes, in 2025, with 'super catch-up' contributions allowed for those aged 60-63 also increased. The IRS said on Friday, Dec. 1, that it...

Power off your phone at least once a week, the NSA advises

From ZD Net – By Lance Whitney – Turning off your phone regularly is one of the NSA's top cybersecurity recommendations. Here's why and what else to know. Your pricey smartphone can be hit by many security threats, from phishing to malware to spyware. All it takes is...

Dimon: ‘Buffett Rule’ approach to taxing the wealthy could solve U.S. debt problem

From Business Insider– By Filip De Mott – JPMorgan CEO Jamie Dimon has put forth a solution to unrestrained US debt: Tax the rich at the same rate as middle-class people, or at a higher rate. The bank executive told "PBS News Hour" in August that the country could...

How the election results will raise or lower your taxes

From The Wall Street Journal – By Richard Rubin – WASHINGTON—Taxes could go up, down or completely sideways next year, depending on which political party controls which parts of the government after the November elections.From The Wall Street Journal – By Richard...

How to structure retirement income to tamp down taxes on savings

From Social Security to IRAs and investments, with smart tax planning, retirees can have some control over how much of their income they'll get to keep. From Kiplinger – By Rick Barnett – Retirement isn’t the end but rather a new beginning. A time to enjoy the...

20 tech experts share how to protect your identity online

From Forbes– By the Forbes Technology Council – As consumers, we’ve likely run across cautionary tales and product ads focused on identity theft in a variety of media, from television commercials to podcasts and online news sources to local radio. It’s not surprising...

Harris win could supercharge $90 trillion Great Wealth Transfer

From Fortune – By Jane Thier – It’s good to be young. Even better if you have rich parents. But they’ve got to act quickly: If Democratic nominee Kamala Harris is elected in November—which many polls predict will happen—ultra-wealthy parents will have a much harder...

Converting a $640k 401(k) to a Roth IRA: Can I avoid taxes?

From Smart Asset – By Mark Henricks – Converting a 401(k) to a Roth IRA can potentially provide valuable long-term benefits, but it also triggers a tax bill that you’ll need to plan for. While the taxes on a Roth conversion can’t be avoided, savers can reduce the...

IRS method of ‘last resort’ to collect overdue taxes: Revoking your passport

From CNBC – By Greg Iacurci – Travelers, be warned: The federal government may revoke your passport if you ignore a big tax bill. Such punishments have become more frequent in recent years, experts said. Federal law requires the IRS and Treasury Department to notify...

A tax deduction business owners love is set to expire in 2025

From Marketplace – By Kimberly Adams – Many provisions of the 2017 tax law are set to expire at the end of 2025. Advocates are already attempting to convince Congress to extend or make permanent key provisions, even as concerns about the growing budget deficit make...

Trump, Harris agree on one thing: No taxes on tips. How about the budget?

From USA Today – By Maya Marchel Hoff – The conversation around eliminating taxes on tips for service and hospitality workers is being reignited after former President Donald Trump and Vice President Kamala Harris have come out in support of it on the campaign trail....

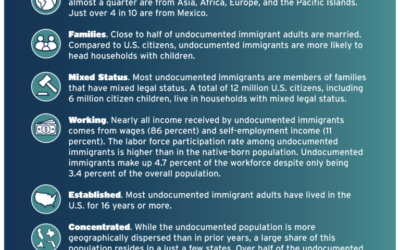

Tax payments by undocumented immigrants study released

A Report from the Institue on Taxations and Economic Policy – July 30, 2024 – Key findings: Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Most of that amount, $59.4 billion, was paid to the federal government while the...