Featured Articles & Tax Tips Blog

Welcome to the CPA Advisory Group’s Featured Articles Blog. Here we share tax and accounting news and tips for our clients on a regular basis. Please feel free to suggest ideas for topics you would like to see addressed, by dropping an email to [email protected]. Enjoy the articles and subscribe to our newsletter for periodic email updates.

Dirty Dozen: Watch out for email, text message scams during tax season

From the IRS Newsroom – With the filing deadline quickly approaching, the Internal Revenue Service is urging everyone to remain vigilant against email and text scams aimed at tricking taxpayers about refunds or tax issues. In day two of the annual Dirty Dozen tax...

Don’t believe these tax myths. Here’s what to know before you file

From CNBC – by Sharon Epperson – You may have heard that many taxpayers are in for a big surprise this tax season if they're banking on a big refund check — or one that's even close to the amount they received last year — but that's more of a "tax myth" than...

What’s legit and what’s a scam? Clues to spotting scammers

From FTC Consumer Advice – By Jim Kreidler, Consumer Education Specialist – People make up lots of stories about why you need to send them money. They might say you’ve won a prize, your family member is in an emergency, or that they love you. And in all these...

Four steps for creating a budget for your business

From AccountingToday.com — By Justin Hatch — Running a profitable business is not an easy task, as evidenced by the high failure rate of new businesses. According to the Bureau of Labor Statistics, 18% of new businesses fail in the first year, while up to 65% fail by...

Be aware of these tax-free income opportunities

Dear Clients and Friends, Do you know all the ways to collect tax-free income and gains? There are more than a few ways to do it. Here’s a summary of what we think are some of the best federal-income-tax-free opportunities for individual taxpayers. Tax-free capital...

Take deduction for energy-efficient improvements to commercial buildings

From Pinnacle CPA Advisory Group/Thomson Reuters — To our Clients and Friends, Commercial building owners get a tax deduction if they install Energy-efficient Commercial Building (EECB) property, whether the building is newly constructed or already in...

What the IRS’ adjusted tax brackets mean for your taxes

From CBS News Moneywatch — By Aimee Picchi — Americans could save on taxes this year because of historically large inflation adjustments set by the IRS. The agency adjusted many of its 2023 tax rules to help taxpayers avoid "bracket creep." That's when workers...

Mileage deduction tips for business owners

From Forbes — By Vlad Rusz — Bianca started her massage therapy business three years ago after getting her license. She began by offering in-home services to the local area. However, as more referrals poured in, her business gradually grew to encompass larger...

FCC seeks to stop unwanted robocalls and texts

From the FCC — Unwanted calls — including illegal and spoofed robocalls — are the FCC's top consumer complaint and our top consumer protection priority. These include complaints from consumers whose numbers are being spoofed or whose calls are being mistakenly...

Millennial Money: 4 expenses for parents to rethink in 2023

From the Associated Press/NerdWallet — By Elizabeth Ayoola — When inflation rises, child care expenses do, too. If you’re a parent, you may be hoping to get a little financial relief during the upcoming tax season through deductions or credits. But since there...

IRS service issues are improving, says new watchdog report

From the Associated Press — By Fatima Hussein — The IRS is beginning to see “a light at the end of the tunnel” of its customer service struggles, thanks to tens of billions of new money from the Democrats’ climate and health law and the authority to hire more...

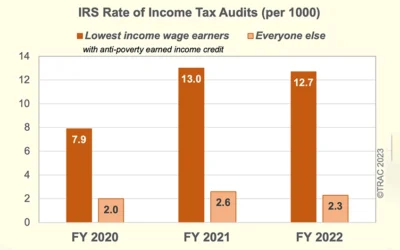

IRS audit rates declined further in 2022

From AccountingToday.com — By Michael Cohn — The Internal Revenue Service audited fewer taxpayers last year, according to a new report, although audits of millionaires ticked up slightly. The report, released Wednesday by Syracuse University's Transactional...