Featured Articles & Tax Tips Blog

Welcome to the CPA Advisory Group’s Featured Articles Blog. Here we share tax and accounting news and tips for our clients on a regular basis. Please feel free to suggest ideas for topics you would like to see addressed, by dropping an email to [email protected]. Enjoy the articles and subscribe to our newsletter for periodic email updates.

IRS gives gig workers extra year to prep for major tax change

From Yahoo Money — By Martha C. White — As inflation continues to pinch Americans’ budgets and labor demand remains high, it’s likely more people will look to supplement their income — and the tax man is starting to take a much closer look. For now, things remain...

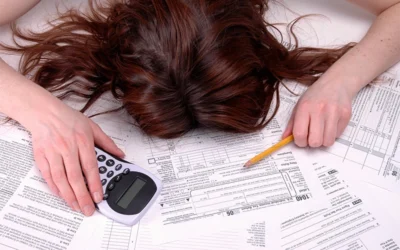

3 things money experts are doing now, before tax season

From NextAdvisor in Partnership with TIME — BY ALEX GAILEY, FEATURED CONTRIBUTOR — That time of year is right around the corner. I’m not talking about the holidays. I’m talking about tax season. While taxes might be the furthest thing from your mind right now, there...

So, you want to get away? Start with avoiding travel scams

From the Federal Trade Commission (FTC) — You may get a call, a text message, or a flyer in the mail. Or maybe you'll see an online ad promising free or low-cost vacations. Scammers and dishonest companies are often behind these offers. You may end up paying hidden...

Millions of Americans set to get surprise 1099-K forms in ’23

From Axios — BY EMILY PECK— There's a tax headache ahead next year for millions of Americans who use apps like Venmo or Paypal regularly, part of a little-noticed change passed in March as part of the American Rescue Plan. Why it matters: Anyone who was paid more...

8 tips for managing a financial windfall

From Forbes — By E. Napoletano, Contributor — According to a recent study by Cerulli Associates, there’s a massive transfer of wealth poised to happen in the U.S. over the next 25 years. An estimated $68 trillion will change hands, with the country’s aging population...

IRS prodded to work more on closing tax gap

From Accounting Today — By Michael Cohn — The Internal Revenue Service (IRS) is being pushed by the Government Accountability Office to do more to close the $428 billion annual tax gap by using the extra $80 billion it's getting over 10 years from Congress to improve...

Is the FBI calling to ask you for money? Hang up. That’s a scam

From the Federal Trade Commission (FTC) — By Gema de las Heras, Consumer Education Specialist — Unwanted calls are annoying — but when a caller says they’re an FBI agent collecting on a legal judgment entered against you, it’s also scary. No matter how urgent and...

Probes sought of whether Trump used IRS against critics

From Accounting Today — By Michael Cohn — Democrats on the tax-writing House and Ways Means Committee are asking the Justice Department and the Treasury Inspector General for Tax Administration to investigate former President Donald Trump's attempt to enlist the...

IRS compliance looking at partnership distributions, ‘outside basis’

From Thomson-Reuters and the Pinnacle CPA Advisory Group — To our Clients and Friends, The IRS sets up compliance campaigns to address areas where it believes there are significant issues. In other words, these are areas where the IRS thinks there is an opportunity to...

Tax breaks after 50 you can’t afford to miss

From AARP — If you’re 50 or older, there is one benefit to reaching this milestone that you may be overlooking: tax breaks aimed right at you. Now you can contribute more to your Roth or traditional individual retirement account (IRA), to your employer-sponsored plan...

IRS increases allowed 401(k) contribution limits for 2023

From CNN Business — By Jeanne Sahadi — The IRS this month announced record increases in contribution limits to 401(k) and other tax-deferred retirement plans for 2023. Starting next year, you will be allowed to contribute up to $22,500 into your 401(k), 403(b), most...

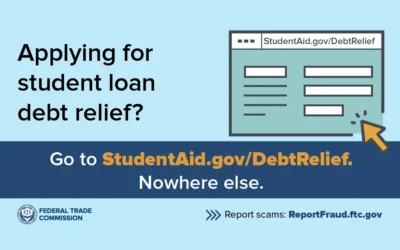

Now that the student loan debt relief application is open, spot the scams

From FTC.gov — By K. Michelle Grajales, Attorney, Division of Financial Practices — The Department of Education (ED)’s application for federal student loan debt relief is now open and, of course, scammers are on the move — trying to get your money and personal...